Since January 1st, 2014, U.S. health care law requires all people age 0-64 years old to purchase health insurance. Covered California is the state’s marketplace for the federal Patient Protection and Affordable Care Act which eliminates industry practices that include rescission and denial of coverage due to pre-existing conditions. Health insurance is complex, confusing and often overwhelming. We have gathered resources to better inform you about health insurance to help you make decisions.

Since January 1st, 2014, U.S. health care law requires all people age 0-64 years old to purchase health insurance. Covered California is the state’s marketplace for the federal Patient Protection and Affordable Care Act which eliminates industry practices that include rescission and denial of coverage due to pre-existing conditions. Health insurance is complex, confusing and often overwhelming. We have gathered resources to better inform you about health insurance to help you make decisions.

************************************************************************************

- As a current Covered CA member, you have the opportunity to renew your coverage beginning October 1, 2023.

- To have coverage on January 1, 2024, please renew your plan by December 15, 2023.

- Open Enrollment will end on January 31, 2024.

************************************************************************************

On-Exchange(Covered California) VS. Off-Exchange

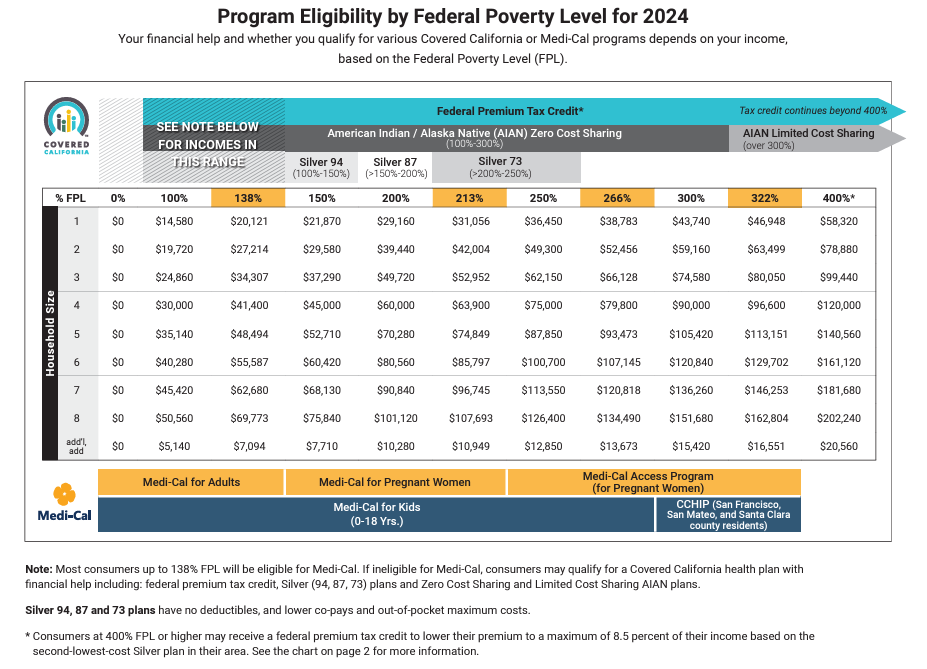

Covered California is the state exchange that helps individuals determine whether they are eligible for Federal premium assistance that is based on available income to reduce insurance costs or whether they are eligible for low-cost or no-cost Medi-Cal. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget.

Off-Exchange is a health insurance policy that is not available for purchase through a federal or state exchange. Off-Exchange can be purchased directly from carriers or through an agent or broker, outside of the state health insurance exchange, and there is no premium assistance from the government. It is also approved under the Affordable Care Act.

Covered California health insurance plans — and all health plans in the individual and small-group markets — are sold in four primary levels of coverage: Bronze, Silver, Gold and Platinum.

- Bronze: On average, your health plan pays 60 percent of your medical expenses, and you pay 40 percent.

- Silver: On average, your health plan pays 70 percent of your medical expenses, and you pay 30 percent.

*In some cases, individuals may qualify for an Enhanced Silver plan. This means that when they choose a Silver plan, they have – based on their income – enhanced out-of-pocket savings through lower copays, coinsurance and deductibles. Individuals in these savings categories get the benefits of a Gold or Platinum plan for the price of a Silver plan. In the three categories of Enhanced Silver, the plan pays either 94 percent, 87 percent or 73 percent of expenses, with the enrollee responsible for the rest. - Gold: On average, your health plan pays 80 percent of your medical expenses, and you pay 20 percent.

- Platinum: On average, your health plan pays 90 percent of your medical expenses, and you pay 10 percent.

Income Guideline

Tax Penalty

In 2022, the annual penalty is the greater of:

- $325 for each adult and $162.50 for each child, up to $975 per family.

- 2 percent of the tax filer’s annual household income minus the federal tax-filing threshold.

APAC Service Center and Insurance Services is a Covered CA Certified Agent that can help you determine if you qualify for a financial help in paying your health insurance and navigate the entire enrollment process.

APAC offers the lowest insurance prices in town. You can quote it online or contact us at (626)291-2200 to get a quote.

APAC offers the lowest insurance prices in town. You can quote it online or contact us at (626)291-2200 to get a quote.